Waaree Energies IPO’ Rs 4321 – crore Initial Public Officer (IPO) was Start previous day ( Yesterday ) .On 21 October it is the First day of Bidding, after the issue subscribed 3.32 times with bids worth 6.98 billion for the public offer shares as against 2.1 crore shares on offer, showed as Exchange Data.

The Company is a major player in the solar Energy industry, Focused on PV Module Manufacturing with an aggregate installed Capacity of 12 GW in last year June 30, 2023.

WAAREE ENERGIES IPO GREY MARKET PREMIUM which crossed the 100 percent premium ahead of its initial share at yesterday.

NSE DATA BASE (WAAREE ENERGIES IPO)

As per NSE data a non-institutional Investors were at the Forefront, buying nearly 8.09 times the portion reserved them.

The Retail investor Portion was booked 3.17 times while the employee quota is subscribed 1.57 times by people.

QIBS or Qualified Institutional Buyers purchased 8 percent of the issue reserved for them.

The IPO Consists of afresh issue of Equity shares worth Rs 3600 Crore and an offer for Sale (OFS) of 48 lakhs Shares. valued at Rs 721.44 crore at the upper end of the price band, from promoters and their existing Shareholders. The total issue size amounts to Rs 4,321.44 crore.

Price band Company (WAAREE ENERGIES IPO )

At the upper end of the Price Band, The Company’s Market Valuation is Estimated at Over Rs 43,179 crore Post issue.

- In Odisha the fresh issue will primary be used to establish a 6GW Manufacturing Facility in Odisha, which will produce Ingot Wafers, Solar Cells and Solar PV modules.

- for general accorporating purposed Fund are also collectable.

Major Points:

The Company Currently Operates Five Manufacturing facilities across India: Surat Tomb Nandigram and chikhli in Gujarat and the Indo Solar Facility in Noida Uttar Pradesh.

we requested to all viewers and readers if you want to invest in this market, we advise you to check with certified experts before taking any Investment Decisions.

Waaree Energies IPO Valuation

It is Based upon its Pb (Price Band) and DRHP is:

| PARTICULARS | VALUE |

| Upper Price Band | Rs 1503 |

| Existing Share | 26.33 Cr |

| Fresh Issue | 3600 Cr |

| Market Cap | 43173.99 Cr |

| EPS (FY24 ) | Rs 48.04 |

| PE Ratio | 31.28x |

| Industry | 151.13x |

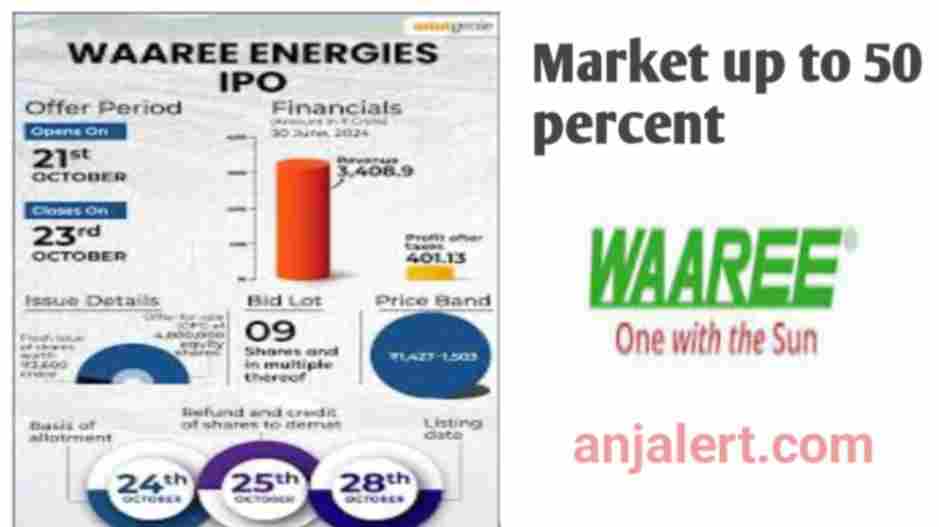

IPO DETAILS:

| Price Band | 1427-1503 |

| Issue Size | 4321.44 Cr |

| Issue Type | Book Built |

| Open | 21-10-2024 |

| Close | 23-10-2024 |

| Listing Date | 28-10-2024 |

Waaree Energies IPO Issue Size

Waaree Energies IPO issue Size is 4321.44 Cr

| Issue | Amount |

| Fresh Issue | 3600 Cr |

| Offer For Sale | 721.44 Cr |

Market Lot

An Individual person can apply for a Minimum – 9 shares, While Maximum – 14 lots of 126 shares.

| Application | Lot | Shares | Amount |

| Minimum | 1 | 9 | Rs 13,527 |

| Maximum | 14 | 126 | Rs 1,89,378 |

GMP WAAREE Energies IPO 2024

- On 17 October its Gmp is Rs 1540.

- On 21 October its Gmp is Rs 1475

READ MORE:

PNB Housing Finance Shares Surge Over 10% to a 10-Week High Following Block Deal